With the aim of expanding access to credit for companies and producers in Mato Grosso, the Productive Sector Alliance — formed by Famato, Fecomércio-MT and Fiemt — requested the federal bench to increase the percentage of transfers from the Constitutional Fund for Financing the Central-West (FCO) via credit unions. The proposal is to increase from 10% to 20% the resources operated by these institutions, which have greater capillarity in the state and greater capacity to serve small entrepreneurs.

The topic was discussed during a breakfast held this Monday (19.05), at the Fiemt headquarters, in Cuiabá, with the presence of the presidents of Famato, Vilmondes Tomain, of Fecomércio-MT, José Wenceslau de Souza Júnior, of Fiemt, Silvio Rangel, of the leader of the federal bench of Mato Grosso, federal deputy Coronel Fernanda, and of the parliamentarians Coronel Assis, Gisela Simona and Rodrigo da Zaeli. Representatives of the financial cooperatives also participated.

“The Alliance was created with the purpose of working on joint agendas that benefit regional development. This is a fair, strategic and urgent demand to unlock access to credit at the ends of the earth, where those who need investment to produce the most are,” said the president of Fiemt, Silvio Rangel.

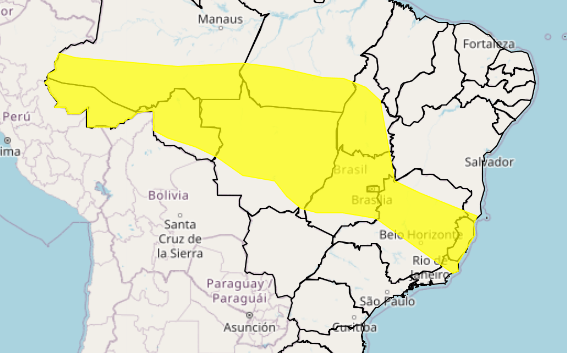

The legislative projects supported by the Alliance include Bills 5187/2017, 912/2012 and 532/2015, which address the expansion of the participation of financial cooperatives as agents for transferring resources from the FCO and other constitutional funds. According to a survey presented by the entities, the cooperatives are present in 159 municipalities in the Central-West region where Banco do Brasil — the fund's current main operator — does not have branches. In Mato Grosso, 95% of the municipalities have at least one credit cooperative unit.

“Today, two-thirds of bank branches in the Central-West region are cooperatives. This means that we have a more dispersed structure and are present in the regions where credit makes the most difference. We want a fairer distribution of the FCO,” highlighted the president of Sicredi Centro Norte, João Spenthof. “In addition, cooperatives release credit with a lower average ticket, that is, more dispersed, which expands the reach and promotes small businesses.”

Another relevant piece of information presented during the meeting was the underutilization of constitutional fund resources. Between 2002 and 2024, 10% of the total FCO — approximately R$$ 4.5 billion — was not used. In the case of the FNO (North), the non-utilization rate was 25%, and in the FNE (Northeast), it reached 50%.

“What we see is a paradox: we have surplus resources and, at the same time, producers and businesspeople who cannot access this money. It is a model that needs to be reviewed urgently,” said the superintendent of OCB/MT, Frederico Azevedo.

The president of Fecomércio-MT, José Wenceslau de Souza Júnior, highlighted the importance of credit and working capital for new investments and the development of commerce. “Speaking specifically about commerce, we had a large number of entrepreneurs who needed the FCO during the Covid-19 pandemic and are now in difficulties. We are asking for a more attractive interest rate so that everyone can restabilize their businesses and that these resources reach all municipalities in our state through our credit unions,” he said.

Congresswoman Coronel Fernanda acknowledged the legitimacy of the agenda and promised to expand the dialogue with the region’s parliamentarians. “This is a fair agenda. I will present the proposal to the other members of the Mato Grosso caucus and also work with my colleagues from Mato Grosso do Sul, Goiás and the Federal District. It is time to build a common agenda for the Central-West. Our role is to ensure that public resources reach those who need them, especially where the State and banks cannot reach them.”

“Presenting this data to the federal bench is strategic to highlight the relevance of financial cooperatives in strengthening regional development policy. With broad reach and presence in thousands of municipalities, these institutions expand access to credit and promote greater efficiency in the application of public resources. For the productive sector, this is a measure that directly contributes to the competitiveness and sustainable growth of our state and the country,” said Famato president Vilmondes Tomain.

The Alliance's proposal is to expand credit and ensure greater agility and efficiency in the application of public resources, promoting regional development in an inclusive and sustainable manner. New meetings between the group and the productive sector should take place every two months, according to the proposal presented during the meeting.