The combination of the appreciation of nitrogen fertilizers and the decline in corn prices raises an alert for the costs of the 2025/26 second crop in Brazil. The conflict between Israel and Iran, which has gained momentum in recent months, has directly influenced the global input market, especially urea, the main source of nitrogen used in the production of the cereal.

Photos: Courtesy of AtmosMarine

According to the June Monthly Agro Bulletin from Itaú BBA's Agro Consulting, the situation is particularly delicate for Brazil, which is one of the main destinations for urea produced in Iran — a country that accounts for around nine million tons per year and has approximately 25% of its exports in the Brazilian market. The increase in the input has further deteriorated the exchange rate with corn, which was already being pressured by the fall in grain prices. With only 25% of fertilizers purchased so far, the expectation is that the costs of the next off-season will be even higher.

Meanwhile, in the United States, the June report from the Department of Agriculture (USDA) kept the balance of the 2025/26 harvest practically unchanged. Production was maintained at 401.8 million tons, with consumption estimated at 324.8 million tons. The consequence is an expectation of growth of almost 30% in North American final stocks, even with the forecast of a global reduction, which fell from 278 million tons projected in May to 275 million tons now, representing a drop of 3% compared to the 2024/25 harvest.

Photo: Gilson Abreu

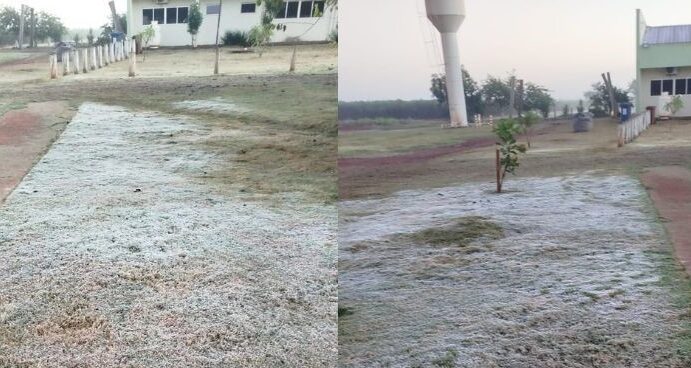

Although planting progress is much of the time above the five-year average, wetter weather and slightly below-normal temperatures in the Midwest may delay corn germination. Such delays have historically been associated with yield losses. In addition, excessive rainfall in some regions may result in a downward revision to corn acreage in the area report due in late June.

Still, barring any extreme weather events that are off the radar, expectations are for a significant North American harvest. The market remains attentive to climate developments and the release of the quarterly report on planted area, which should directly influence price behavior in the short term.

With the American harvest expected to be robust and the cost of fertilizers on the rise, Brazilian corn producers will face a challenging scenario when defining their planning for the 2025/26 second crop, especially if the exchange rate remains unfavorable.