![]()

The first rains are already beginning to arrive in the state of Mato Grosso, the largest soybean-producing state in the country, but they are still insufficient to allow producers to advance their field work and get everything ready for the start of the 2025/26 harvest. The videos below, sent by Gilberto Leal, head of commodities at Granel Corretora, show some volumes arriving in Campos de Júlio and Tangará da Serra, important production regions in the state.

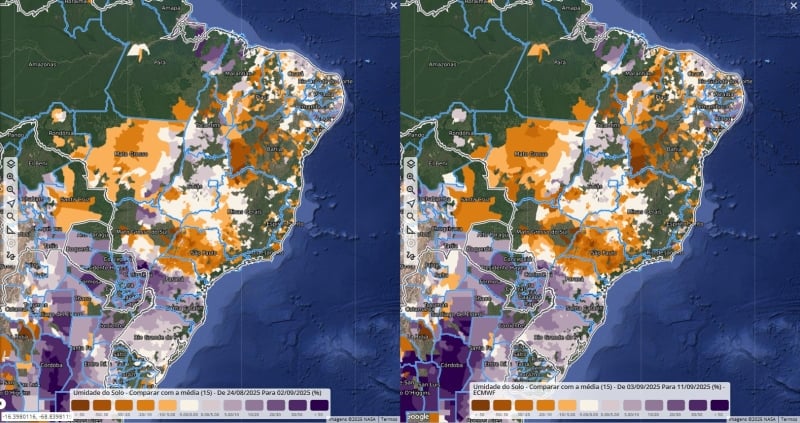

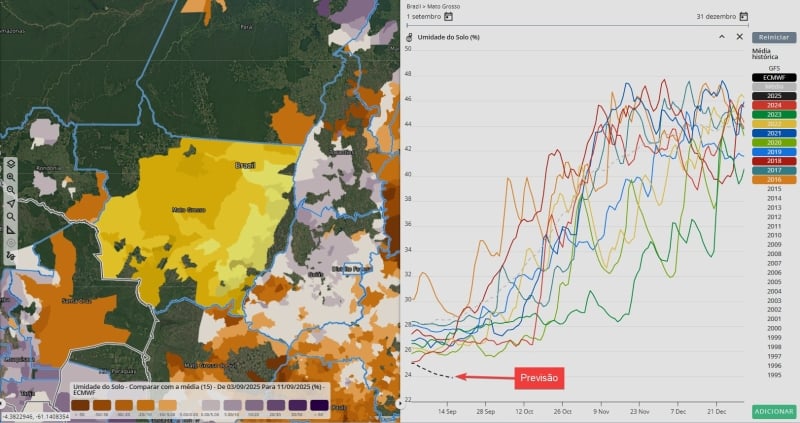

According to Felippe Reis, a crop analyst at EarthDaily Agro, soil moisture in Mato Grosso is already below average, which could cause producers to wait for the rains to return before starting planting.

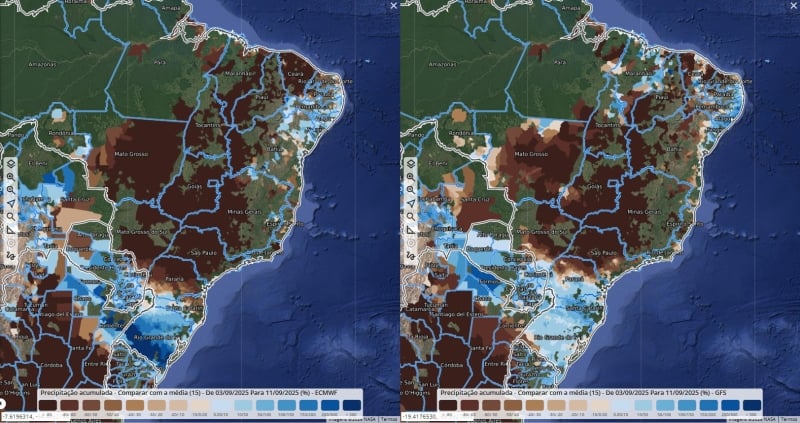

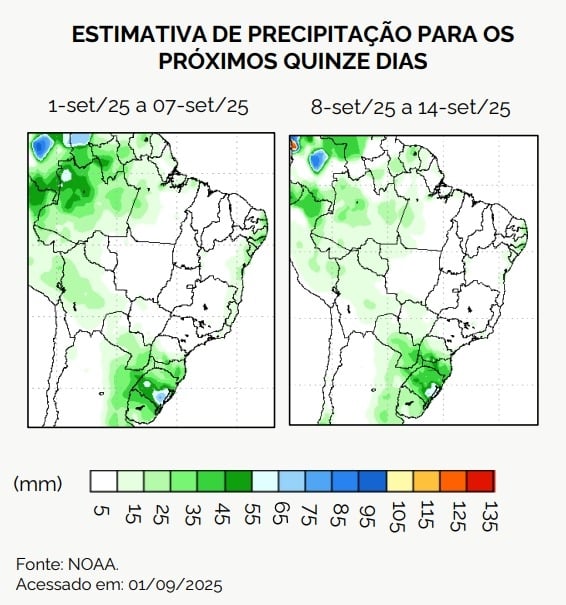

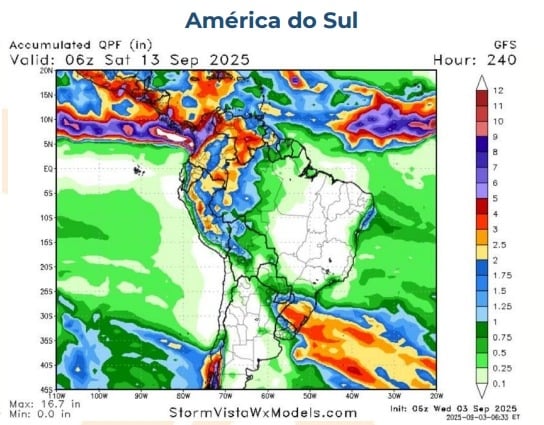

However, for now, "both the European climate model (ECMWF; left) and the American climate model (GFS) indicate above-average rainfall only in the south of the country, mainly in Rio Grande do Sul. Therefore, soil moisture is expected to remain low in Mato Grosso," says Reis.

According to the analyst, soil moisture in the state is expected to remain at its lowest level in the last 10 years, considering the first half of September. "This scenario reinforces the possibility of a delay in the start of soybean planting in Mato Grosso."

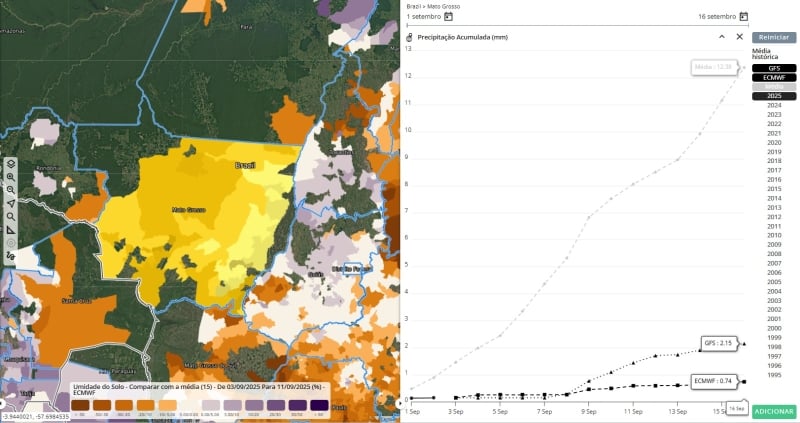

“The forecast is that the accumulated precipitation will be 0.74 (ECMWF) to 2.15 mm (GFS) considering September 1st to 16th. The average of the last 30 years for the period is 12.38 mm”, adds Reis.

The end of the sanitary vacuum in Mato Grosso, according to MAPA (Ministry of Agriculture and Livestock), ends on September 6, however, for soybean planting to begin effectively it would be important for the rains to establish themselves in the state, arriving not only in good volumes and with good coverage so that it can guarantee good levels of moisture in the soil.

According to NOAA data, rainfall over the next fifteen days is expected to be insufficient to allow planting immediately after the end of the drought period in most of Mato Grosso. This situation is similar to last year, when rainfall was initially delayed, but normalized by the end of the month," states the weekly report from IMEA (Mato Grosso Institute of Agricultural Economics).

Thus, IMEA experts also highlight the information that shows that “the forecast for the El Niño–Southern Oscillation (ENSO) phenomenon still indicates neutrality, a condition that tends to favor a better distribution of rainfall in the

state".

More than that, the institute also states that if the rains are delayed more than currently predicted, they could cause a concentration not only of planting, but also of harvesting, which ends up leaving the crop more exposed to risks, should they arise.

For the national scenario, climate models show that the first 10 days of September will be even drier, with heavier rainfall only in the south of the country. The map below, from the GFS model, shows the rainfall forecast through September 12th.

In this scenario, there are different realities for the start of planting, as Gilberto Leal explains. According to him, cotton producers should move forward with sowing, even if it's in the dust, to ensure the most suitable window for the fiber. For producers whose main crop is soybeans, decisions will depend more on the actual and confirmed rainfall, since costs are quite high this season and "they can't afford to make mistakes when planting. They tend to wait for improved humidity to begin planting, and they're relying on the maps for the second half of September."

Where moisture levels are more satisfactory, "those who can anticipate, will do so, also to guarantee the corn window. Because corn, in a way, for ethanol plants in the 25/26 season at R$ 50.00 is very favorable in terms of margins. So, producers tend to accelerate planting a little more also to avoid missing the safrinha window and try to plant 100% corn from the area. This is what we've seen in our region in recent years with the arrival of the plants. There used to be a history of 70% of safrinha planting, and now they're planting 100% of the area, advancing a little further and even taking a little more risk with safrinha corn," explains the specialist.

For soybeans, Mato Grosso is expected to cultivate 13.01 million hectares, which, if confirmed, would represent an increase of 1,671 TP4T compared to the previous harvest. Production of the oilseed, however, is expected at 48.5 million tons, 4,791 TP4T lower than the previous harvest. For corn, IMEA's estimate—the first for the 2025/26 harvest—is 7.39 million hectares, 1,831 TP4T more than the previous harvest.

“According to the Institute, the North, Northeast and Northwest regions, which still have greater availability of areas capable of migration (other crops for corn), should

to concentrate growth. The highlight in terms of area was the Northeast, which is expected to grow 4,31% in the crop-to-crop comparison, reflecting producers' return to corn cultivation, as sesame prices are less attractive so far," states the institute's weekly report.

Thus, the 2025/26 corn production in Mato Grosso is expected at 51.72 million tons, 6.7% less than the record registered in the previous harvest.

“Finally, it is important to emphasize that climatic factors will be decisive in consolidating the projections.”